Statement

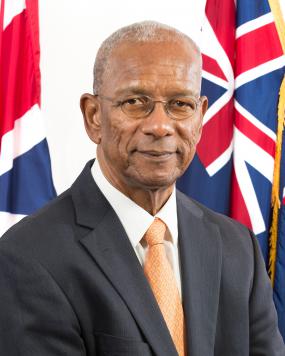

STATEMENT BY THE HONOURABLE PREMIER AND MINISTER OF FINANCE DR. THE HONOURABLE D. ORLANDO SMITH, OBE DURING

HE FOURTH SITTING OF THE FIRST SESSION

OF THE THIRD HOUSE OF ASSEMBLY OF THE VIRGIN ISLANDS

MONDAY, 2ND NOVEMBER, 2015

10:00 A.M.

Amendments to the Anti-Money Laundering Regulations and Anti-Money Laundering and Terrorist Financing Code of Practice

Madam Speaker, with your kind permission, I beg to make the following statement with regard to the amendments to the Anti-money Laundering Regulations and Anti-money Laundering and Terrorist Financing Code of Practice that have recently been approved.

Madam Speaker, with your kind permission, I beg to make the following statement with regard to the amendments to the Anti-money Laundering Regulations and Anti-money Laundering and Terrorist Financing Code of Practice that have recently been approved.

Madam Speaker, the Virgin Islands prides itself on adhering to international standards and takes very seriously its responsibility in the fight against money laundering, terrorist financing and proliferation financing.

The international standard on transparency of customer relationships, including those involving legal persons and legal arrangements, is the Financial Action Task Force (FATF) Standards on Combating Money Laundering and the Financing of Terrorism and Proliferation.

These FATF Standards outline the globally accepted requirements for the type of information that should be maintained by, and within a country in order to determine true ownership of such entities and arrangements.

Madam Speaker, the Virgin Islands has always strived to meet FATF standards, and in fact was among the top countries in to world to do so, as evidenced by the results of our 2008 Mutual Evaluation.

Since that time, however, the standards have changed, and like other jurisdictions around the world, we have to change and adapt in an effort to ensure that we continue to comply with these global standards, and prevent as best we can, misuse of our financial services products, including corporate vehicles and trusts, for the purposes of ML/TF/PF and other tax related crimes.

Madam Speaker, I am pleased to say that after months of consultation and review, amendments to the Anti-money Laundering Regulations were approved by my Cabinet on 22nd October.

These Regulations have been issued primarily to address the matter of local service providers’ relationships with third parties and the collection and verification of customer due diligence information, including beneficial ownership information.

The Regulations bring the Territory in line with the FATF standards by outlining who may qualify to act as a third party introducer, and ensuring that, where any of our service providers rely on such an intermediary to facilitate its business relationships, the responsibilities of both the intermediary and the service provider in relation to the collection and maintenance of customer information, are clearly defined.

Additionally, the Regulations require service providers to have written agreements with these third parties outlining the responsibilities of each in that regard.

To ensure that there is a base standard for these agreements the Anti-money Laundering and Terrorist Financing Code of Practice has also been amended to provide guidance on what, at minimum, these agreements should contain.

Madam Speaker, in order to ensure that third parties meet their obligations with respect to the collection and verification of customer information once these agreements are signed, the Regulations now put an obligation on local service providers to test their relationships with these third parties to ensure that all relevant information is in fact being maintained in adherence to the terms and conditions of their agreements, and can be provided upon request, without delay.

Further guidance on the conduct of such testing is provided for in the Code of Practice.

Madam Speaker, having regard for the large number of entities that would be subject to these requirements a twelve month compliance period has been provided.

This will allow local service providers time to ensure that all of the relevant information now required to be maintained within the Territory is collected and held for each individual company they represent.

While my Government recognises that for some of our larger service providers collecting all required information by the end of this compliance period may prove challenging, I encourage all service providers to try their utmost to comply with the timeline provided.

Where service providers are facing difficulties in meeting the compliance date, provision has been made to allow for an extension of time to be granted. Service providers will, however, have to display that they have made sufficient progress in collecting the required information to warrant an extension.

The circumstances under which an extension may be granted are outlined in the Schedule to the Regulations and call for service providers to obtain information on at least fifty percent of their clients within seven months of the Regulations coming into force, or on seventy-five percent of their clients within ten months of the Regulations coming into force.

Madam Speaker, it is my Government’s intention to bring the Regulations into force on 1st January 2016, at which time the Code of Practice will also be brought into force.

I, therefore, ask the industry’s ongoing cooperation in meeting the terms of these legislative measures to ensure that the Territory remains compliant with global international standards.

Such compliance will continue to signal the Virgin Islands’ commitment to the fight against money laundering, terrorist financing and proliferation financing, and will help to underscore the high level of transparency that the Territory has always, and continues to exhibit in the conduct of its financial services affairs.

Finally Madam Speaker, amendments of this nature can be challenging and time consuming, as every effort must be made to ensure a proper balance is struck between gaining compliance with the standards and the realities of our existing business environment.

It would, therefore, be remiss of me not to say thank you to the members of the private sector who contributed to the development of these legislative amendments, either through their service on the Joint Anti-money Laundering and Terrorist Financing Advisory Committee, or by way of independent submissions on the matter.

The cooperation between the private sector and the Government in finalising these amendments speaks to the successful public-private partnership that has served this industry so well over the years.

I believe that the current amendments go a long way in satisfying both the industry and the Government’s concerns on the issue of third party relationships and the collection and maintenance of customer due diligence and beneficial ownership information, and I look forward to their smooth and swift implementation.

I thank you Madam Speaker.